Irs Form 941 2025

BlogIrs Form 941 2025. Employers engaged in a trade or business who pay compensation. These changes affect form 941 for the.

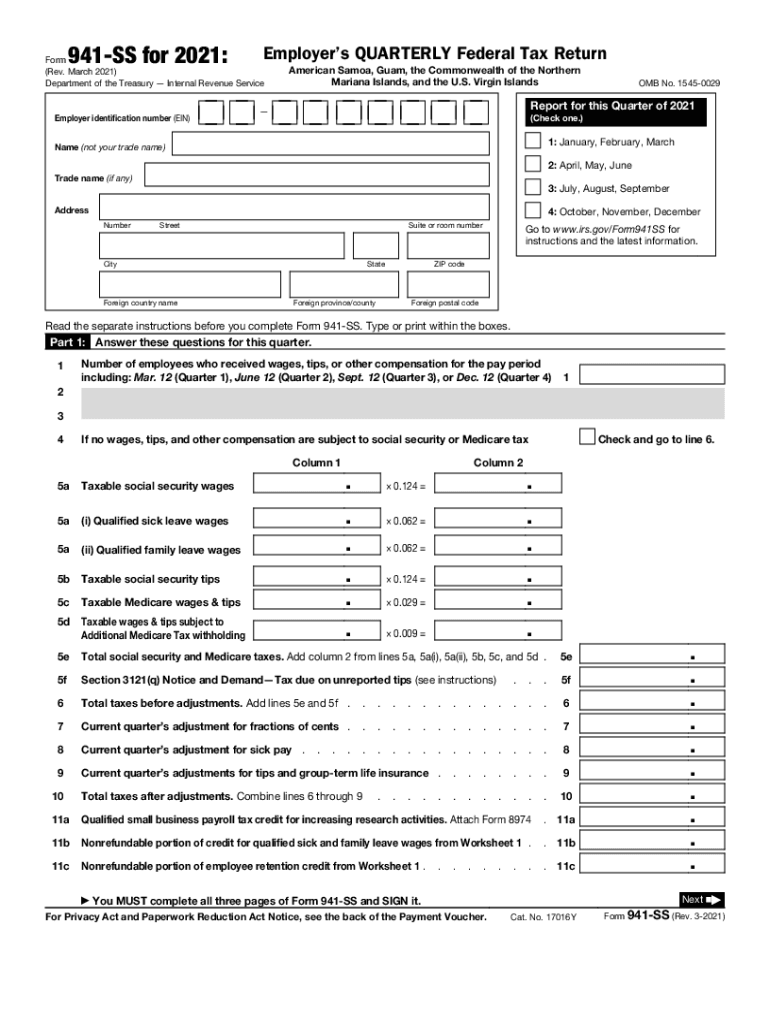

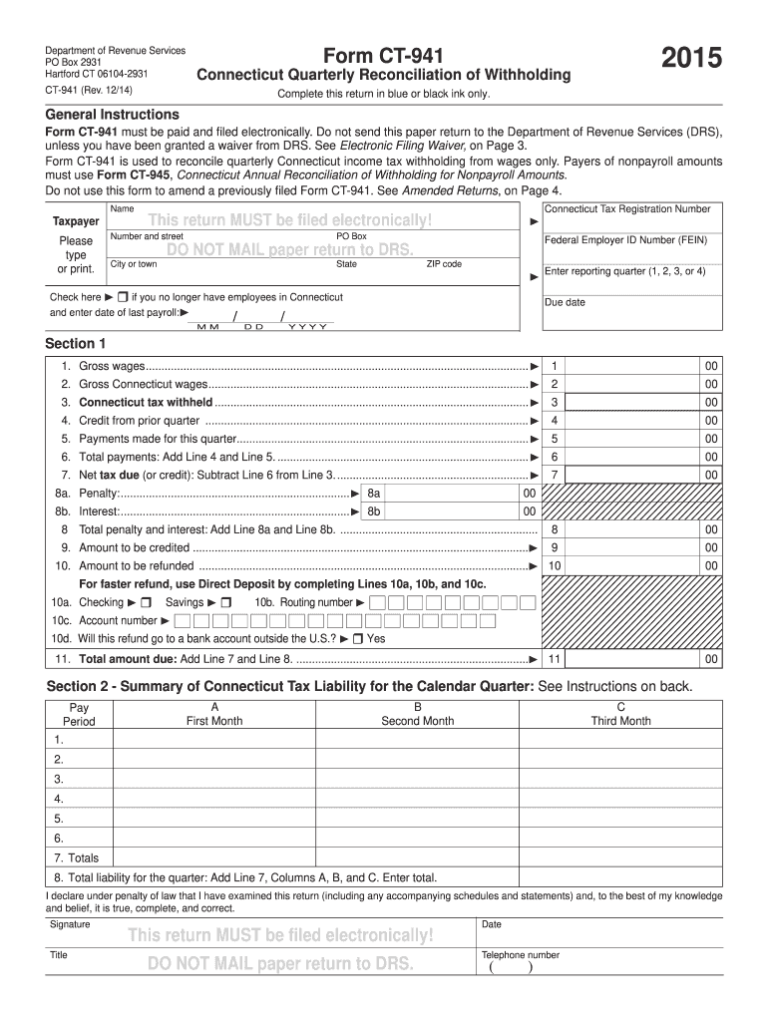

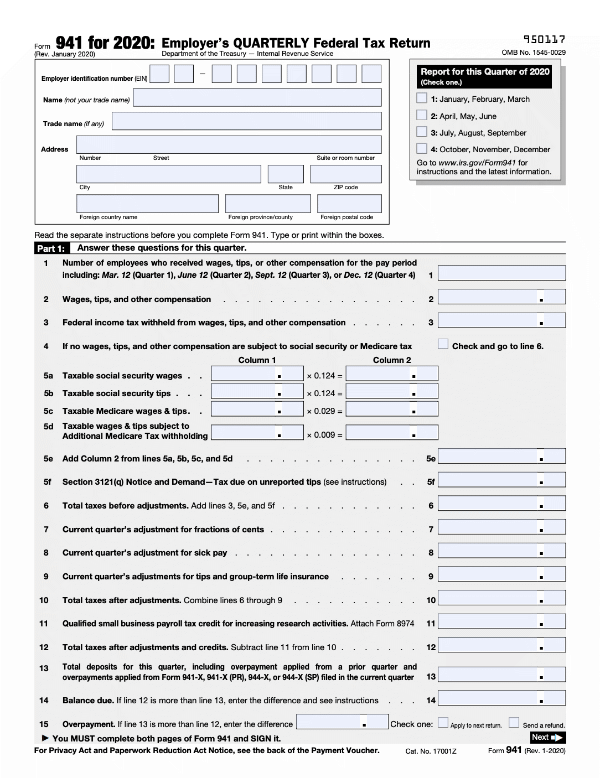

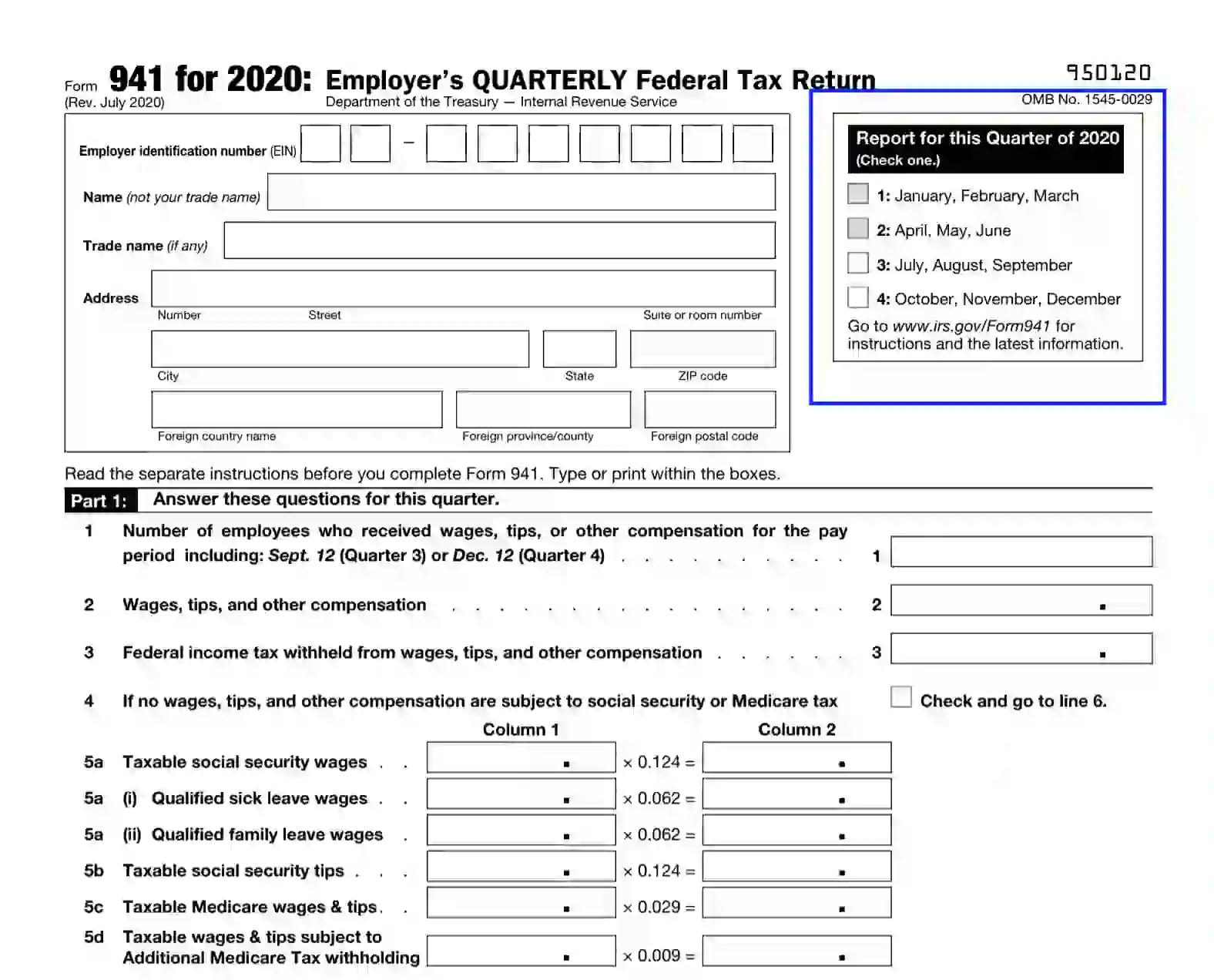

These changes affect form 941 for the. The irs form 941, employer’s quarterly federal tax return, used by businesses to report information about taxes withheld such as federal income, fica.

Irs Form 941 Fillable Pdf Printable Forms Free Online, The employee retention credit (erc) is a refundable tax credit for eligible employers that paid qualified wages after march 12, 2025, and before october 1, 2025.1. Form 941, employer's quarterly federal tax return, reports wage.

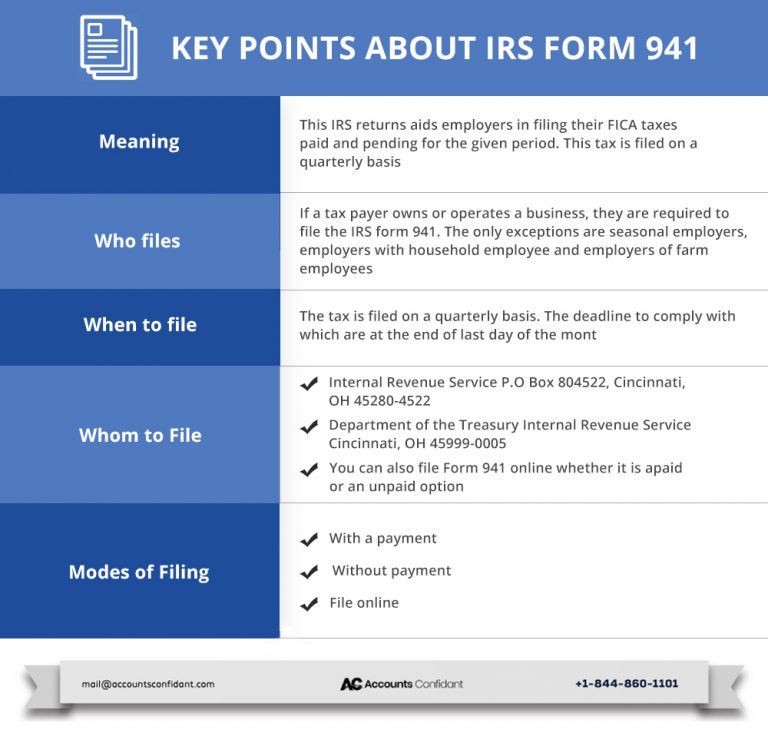

IRS Form 941 Meaning, Instructions and Tips AccountsConfidant, Employer identification number (ein) small businesses. Using ira resources, the irs is launching an ambitious plan to ensure that by filing season 2025, taxpayers will be able to go paperless if they choose to do so, and by.

How to Generate and File IRS Quarterly Federal Form 941, Thus, employers may claim the 2025. Also known as the employer’s quarterly tax form, irs form 941 is used to report income taxes and payroll taxes that employers withheld from employees’ wages.

What Is The Irs Form 941?, Form 941 is filed quarterly, with 2025 due dates of april 30th, july 31st, october 31st, plus january 31st, 2025. The irs form 941, commonly known as the employer's quarterly federal tax return, plays a pivotal role for employers in reporting withheld taxes from.

Revised IRS 941 Form Aatrix, Form 941 is filed quarterly, with 2025 due dates of april 30th, july 31st, october 31st, plus january 31st, 2025. Employer identification number (ein) small businesses.

Irs Form 941 Instructions How To Fill Out Form 941 Fo vrogue.co, Employer identification number (ein) small businesses. Tax year 2025 form 941x (quarterly forms) *note:

What is IRS Form 941?, Form 941 is a quarterly payroll tax form that the majority of employers are required to file 941 with the irs to report the medicare, social security, and income. The available dates are projected and subject to change.

Irs Form 941 TAX, Also known as the employer’s quarterly tax form, irs form 941 is used to report income taxes and payroll taxes that employers withheld from employees’ wages. Tax year 2025 form 941x (quarterly forms) *note:

Ir S Form 941 Fill Out And Sign Printable Pdf Templat vrogue.co, Irs release final regulations implementing. Thus, employers may claim the 2025.

IRS Form 941 Processing AOTM IDP, Tax year 2025 form 941x (quarterly forms) *note: Many employers claimed and continue to claim the credit by amending forms 941, employer's quarterly federal tax return, and requesting refunds.

Bath And Body Christmas 2025. Evergreen sprigs, sugar cookies, marshmallow treats: Bath & body works […]