Tax Brackets For 2025 Single

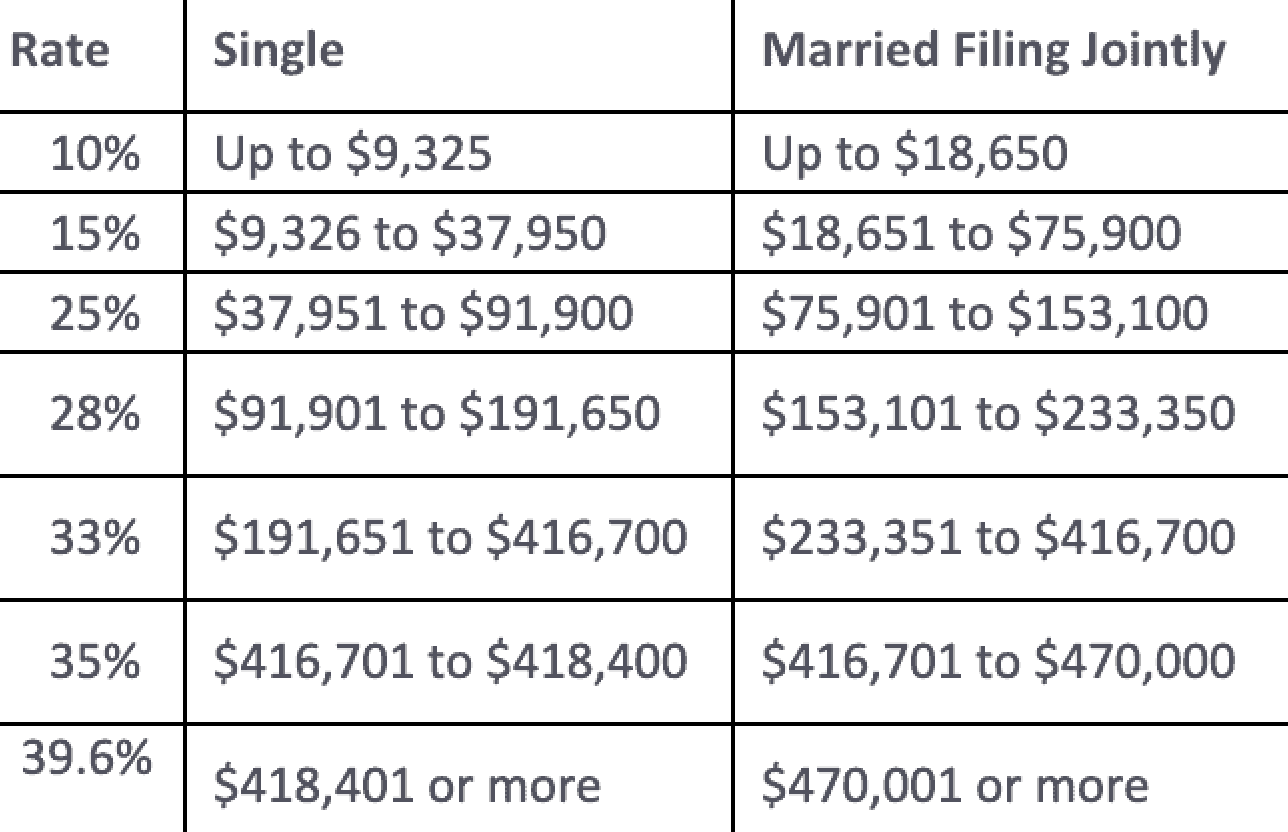

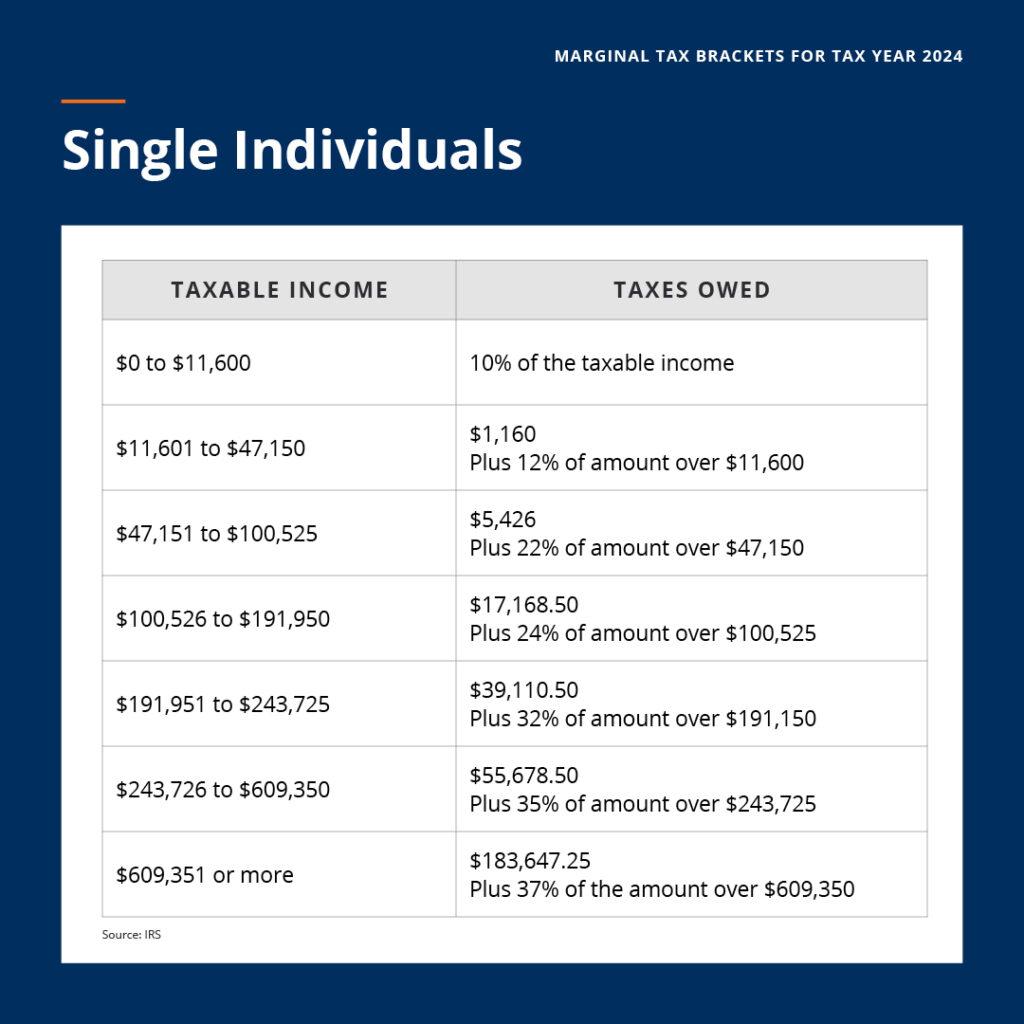

BlogTax Brackets For 2025 Single. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Check your 2025 irs federal income tax bracket to see if you fall into a lower bracket due to inflation, which could lower your tax bill next year.

Unless your taxable income lands you in the lowest tax bracket, you. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

Tax Brackets 2025 Single Filers Jeane Lorelle, To figure out your tax bracket, first look at the rates for the filing status you plan to use:

2025 Tax Brackets And Standard Deduction Table Cate Marysa, None of the seven tax rates that make up the graduated brackets have changed since last year, though the thresholds themselves have been adjusted.

Federal Tax Brackets 2025 Single Mela Stormi, The 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Tax Brackets 2025 Single Person Reeva Celestyn, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

2025 Tax Brackets Announced What’s Different?, There are seven federal tax brackets for tax year 2025.

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 tax brackets Archives Optima Tax Relief, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Tax Brackets For 2025 Single. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Check your 2025 irs federal income tax bracket to see if you fall into a lower bracket due to inflation, which could lower your tax bill next year. Unless your taxable income lands you in the lowest tax bracket, you. To figure…